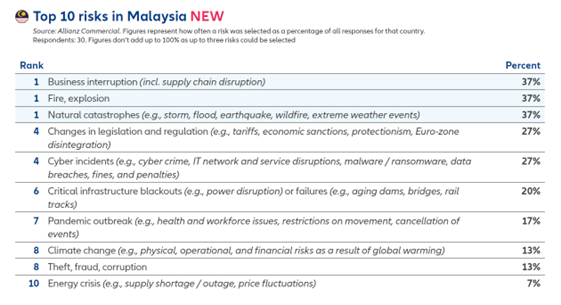

- Changes in legislation and regulation and Cyber incidents emerge joint 4th place with 27%

- Top risks in Asia remain Cyber incidents, Business interruption and Natural catastrophes

- Data breaches, attacks on critical infrastructure or physical assets and increased ransomware attacks drive cyber concerns

Media Release: Allianz Risk Barometer: Business interruption, Fire & explosion and Natural catastrophes tie as the top business risks in Malaysia

Singapore, 16 January 2024

- Business interruption, Fire & explosion, and Natural catastrophes such as storms and floods tie as the top business risks in Malaysia. Changes in legislation and regulation such as tariffs and economic sanctions and Cyber incidents such as ransomware attacks, data breaches, and IT disruptions are the 4th biggest worry for companies in Malaysia in 2024, according to the Allianz Risk Barometer which is based on the insights of more than 3,000 risk management professionals.

- Globally and in Asia, the top three risks are Cyber incidents, Business interruption and Natural catastrophes. Other major concerns of companies in Asia include Fire, explosion (up from #8 to #4 year-on-year) and Climate change (remains at #5).

- Allianz Commercial CEO Petros Papanikolaou comments on the findings: “The top risks and major risers in this year’s Allianz Risk Barometer reflect the big issues facing companies around the world right now – digitalization, climate change and an uncertain geopolitical environment. Many of these risks are already hitting home, with extreme weather, ransomware attacks and regional conflicts expected to test the resilience of supply chains and business models further in 2024. Brokers and customers of insurance companies should be aware and adjust their insurance covers accordingly.”

- Large corporates, mid-size, and smaller businesses are united by the same risk concerns – they are all mostly worried about cyber, business interruption and natural catastrophes. However, the resilience gap between large and smaller companies is widening, as risk awareness among larger organizations has grown since the pandemic with a notable drive to upgrade resilience, the report notes. Conversely, smaller businesses often lack the time and resources to identify and effectively prepare for a wider range of risk scenarios and, as a result, take longer to get the business back up and running after an unexpected incident.

- Christian Sandric, Managing Director of Allianz Commercial Asia, says, “Cyber incidents, business interruption, and natural catastrophes remain the most significant risks for companies in Asia, be it large corporates, mid-size, or smaller businesses. Companies need to navigate an increasingly volatile global business environment, and this reiterates the importance of a strong risk management culture, as well as robust response measures and insurance solutions. For example, companies are increasingly exploring multinational policies that facilitate swift incident response and can help minimize loss and damage, and alternative risk transfer solutions to cover risks that are difficult to insure in the conventional market.”

- Top risks in Asia

- Cyber incidents (36%) ranks as the most important risk globally and in Asia, where it is the top peril in India and Japan. Asia is seeing an increase in cyberattacks and there have been notable cyber incidents in the region, including a cyberattack on Japan’s space agency, data breach of details of citizens with the Indian Council of Medical Research, and outage suffered by South Korean government-run online services.

- Despite an easing of post-pandemic supply chain disruption in 2023, Business interruption (35%) remains a significant concern and is the second biggest threat in Asia. The region, in particular South Korea, Japan, and China, plays an important role in the global upstream supply chain in several industries including active pharmaceutical ingredients and electronic vehicles. This result reflects the interconnectedness in an increasingly volatile global business environment, as well as a strong reliance on supply chains for critical products or services.

- Natural catastrophes (31%) retains its position as the third biggest threat in the 2024 survey. It was the hottest year since records began, while insured losses exceeded US$100bn for the fourth consecutive year, driven by the highest ever damage bill of US$60bn from severe thunderstorms. Natural catastrophes ranks the top risk in Malaysia and Thailand, which experienced floods in different parts of 2023, and continues to affect Japan. The New Year’s Day earthquake which hit central Japan caused destruction and triggered mass evacuations and major tsunami warnings, with insured property losses estimated to be between US$1.8bn and US$3.3bn.

- Top risks in Malaysia

- Rafliz Ridzuan, Chief Underwriting Officer, Allianz General Insurance Company (Malaysia) Berhad, said: “Business interruption is closely linked to many of this year’s highly ranked risks, such as cyber, natural catastrophes, and fire, and remains a key concern in a rapidly changing world. Disruption from fire can be very high, as it can take longer to recover from than many other perils, and the impact on suppliers can often be great. For sectors which deal with highly flammable and explosive materials, damaged facilities can sometimes take years to rebuild and get production back up and running to full capacity. It is crucial that companies have robust risk management plans and supply chains in place to enhance resilience and withstand business interruption.”

- Due to Malaysia’s topography, the country has been susceptible to coastal flooding and flash floods, both of which are increasing in frequency and intensity caused by global warming especially over the last few years. Based on the climate change projection reports released by the World Bank, floods are likely to occur 20% more over the next five years.

- Last year also saw a number of fires in the country, one occurring in Kuala Lumpur's biggest and most popular malls, Mid Valley Megamall. A fire broke out at the main power substation resulting in the closure of the mall for one day. Earlier in 2023, two fires caused by an electrical short circuit at Jakel, a leading textile store in Shah Alam resulted in estimated losses of about RM100mn (US$22mn).

- More recently, a fire broke out at Bukit Selambau affecting three recycling facilities storing recyclable materials such as metal, wires, copper and large batteries. It was reported that the three recycling facilities were operating without proper authorisation and had failed to comply with Department of Environment regulations. Firefighting operations took over 80 hours to complete.

- The top 10 business risks in Malaysia 2024

- View the full global and country risk rankings

- About the Allianz Risk Barometer

- The Allianz Risk Barometer is an annual business risk ranking compiled by Allianz Group’s corporate insurer Allianz Commercial, together with other Allianz entities. It incorporates the views of 3,069 risk management experts in 92 countries and territories including CEOs, risk managers, brokers and insurance experts and is being published for the 13th time.

- For further information please contact:

Swipe to view more

| Global: Hugo Kidston | Tel. +44 203 451 3891 | hugo.kidston@allianz.com |

| Global: Philipp Keirath | Tel. +49 160 982 343 85 | philipp.keirath@allianz.com |

| Johannesburg: Lesiba Sethoga | Tel. +27 112 147 948 | lesiba.sethoga@allianz.com |

| London: Ailsa Sayers | Tel. +44 203 451 3391 | ailsa.sayers@allianz.com |

| Madrid: Laura Llauradó | Tel. +34 660 999 650 | laura.llaurado@allianz.com |

| Munich: Andrej Kornienko | Tel. +49 171 4787 382 | andrej.kornienko@allianz.com |

| New York: Jo-Anne Chasen | Tel. +1 917 826 2183 | jo-anne.chasen@agcs.allianz.com |

| Paris: Florence Claret | Tel. +33 158 85 88 63 | florence.claret@allianz.com |

| Rotterdam: Olivia Smith | Tel. +27 11 214 7928 | olivia.smith@allianz.com |

| Singapore: Shakun Raj | Tel. +65 6395 3817 | shakun.raj@allianz.com |

- About Allianz Commercial

- Allianz Commercial is the center of expertise and global line of Allianz Group for insuring mid-sized businesses, large enterprises and specialist risks. Among our customers are the world’s largest consumer brands, financial institutions and industry players, the global aviation and shipping industry as well as family-owned and medium enterprises which are the backbone of the economy. We also cover unique risks such as offshore wind parks, infrastructure projects or Hollywood film productions. Powered by the employees, financial strength, and network of the world’s #1 insurance brand, as ranked by Interbrand, we work together to help our customers prepare for what’s ahead: They trust us to provide a wide range of traditional and alternative risk transfer solutions, outstanding risk consulting and Multinational services, as well as seamless claims handling. The trade name Allianz Commercial brings together the large corporate insurance business of Allianz Global Corporate & Specialty (AGCS) and the commercial insurance business of national Allianz Property & Casualty entities serving mid-sized companies. We are present in over 200 countries and territories either through our own teams or the Allianz Group network and partners. In 2022, the integrated business of Allianz Commercial generated more than €19 billion gross premium globally.

- These assessments are, as always, subject to the disclaimer provided below.

- Cautionary note regarding forward-looking statements

- This document includes forward-looking statements, such as prospects or expectations, that are based on management's current views and assumptions and subject to known and unknown risks and uncertainties. Actual results, performance figures, or events may differ significantly from those expressed or implied in such forward-looking statements.

- Deviations may arise due to changes in factors including, but not limited to, the following: (i) the general economic and competitive situation in Allianz’s core business and core markets, (ii) the performance of financial markets (in particular market volatility, liquidity, and credit events), (iii) adverse publicity, regulatory actions or litigation with respect to the Allianz Group, other well-known companies and the financial services industry generally, (iv) the frequency and severity of insured loss events, including those resulting from natural catastrophes, and the development of loss expenses, (v) mortality and morbidity levels and trends, (vi) persistency levels, (vii) the extent of credit defaults, (viii) interest rate levels, (ix) currency exchange rates, most notably the EUR/USD exchange rate, (x) changes in laws and regulations, including tax regulations, (xi) the impact of acquisitions including related integration issues and reorganization measures, and (xii) the general competitive conditions that, in each individual case, apply at a local, regional, national, and/or global level. Many of these changes can be exacerbated by terrorist activities.

- No duty to update

- Allianz assumes no obligation to update any information or forward-looking statement contained herein, save for any information we are required to disclose by law.

- Privacy Note

- Allianz Commercial is committed to protecting your personal data. Find out more in our privacy statement.