What you need to know buying your first home

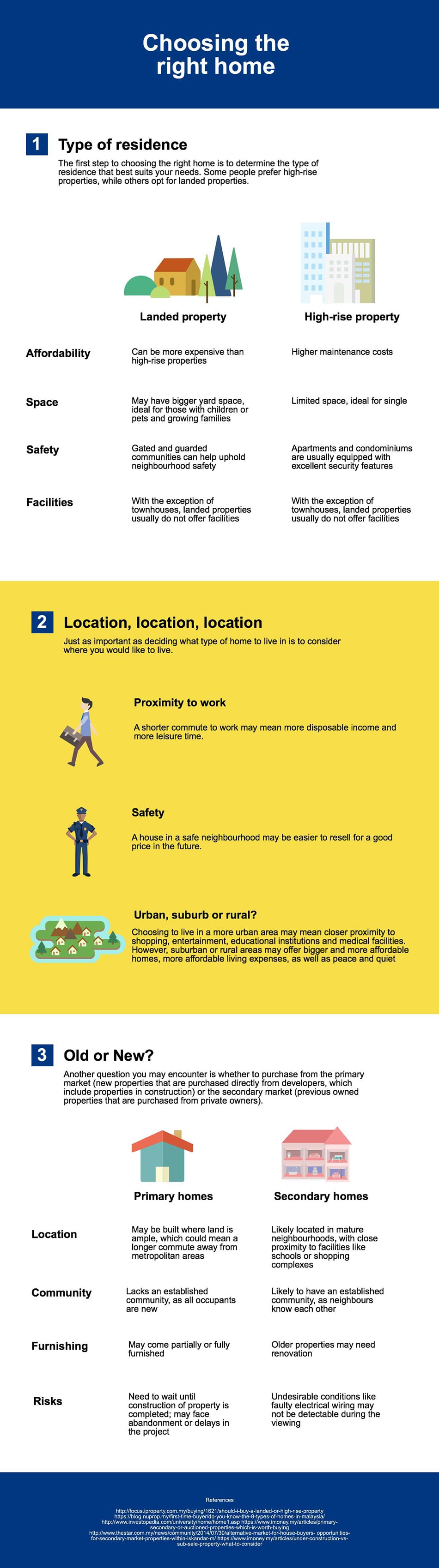

Choosing the right home

Costs of buying a new home

1. Down payment

2. Other upfront costs

You might be surprised to find out that there are other upfront costs to buying a home, such as legal fees and stamp duty costs, which could cause a serious dent to your bank account. Here, we look at the entry costs of houses valued at RM100,000 to RM600,000.

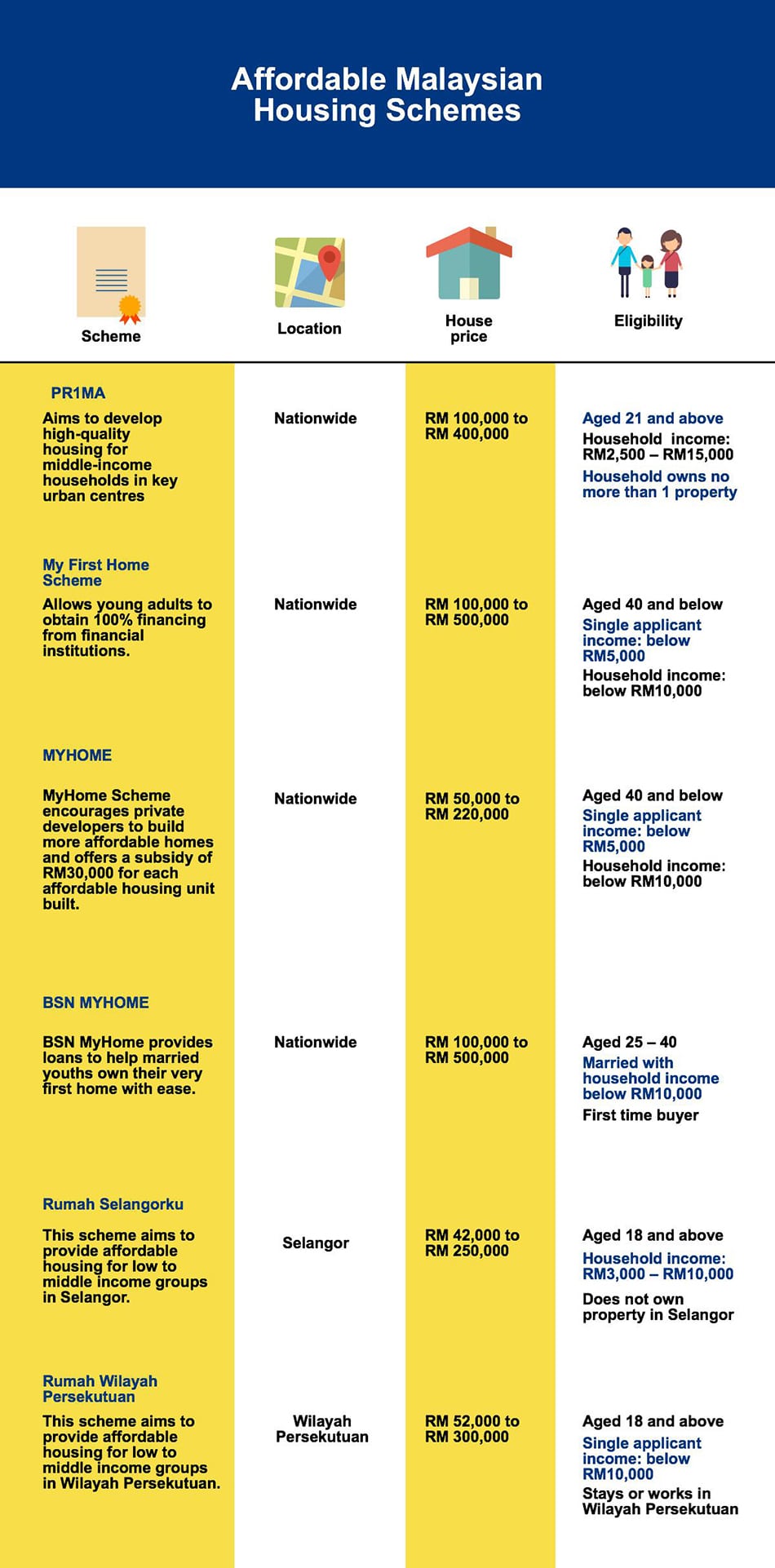

However, if you're a first time buyer, purchasing a property between 1st January 2017 and 31st December 2018 will grant you a 100% exemption from the SPA stamp duty. Additionally, if you qualify for the My First Home Scheme (SRP), you may be able to obtain 100% financing, enabling you to buy a home without having to pay a 10% down payment.

3. Monthly installments

Now that you've paid for the down payment and other upfront costs, you'll have to finance the rest of the purchase price with monthly installments after acquiring a bank loan. Here's an estimated guide of how much you may have to fork out monthly.

These numbers can seem intimidating, especially if you're a young Malaysian with limited savings or disposable income. In order to purchase your first home, you'll want to consider a savings or investment plan that can help you achieve your financial goals.

What to do as a new homeowner

So the house keys have been handed to you, and you are now the proud owner of your very own home...now what?

Don't forget that major events like fire, theft or major structural damages are the basics you need to get insured against. The right home insurance can help cover these losses. Allianz Smart Home Cover will even let you customise your home protection from structure to contents or even cater to your needs as a landlord. You'll have peace of mind knowing that the home you've spent your money on is well protected.

Even if you're comfortably paying your monthly installments, you'll need extra cash tucked away in the event of issues such as repairing faulty wiring or fixing burst pipes. Allianz Smart Home Cover even has a HomeFix component which allows you to choose a specialized home maintenance expert to handle areas which a new home owner might be unfamiliar.

Finally, you'll want to protect the people in your home with right life insurance and medical insurance. After all, a house is merely brick and mortar, but a home is where the heart is.

Reference:

- http://www.freemalaysiatoday.com/category/nation/2017/03/27/93-non-homeowners-expect-to-own-a-house-in-5-years/

- https://www.imoney.my/articles/buy-house-in-malaysia

- https://loanstreet.com.my/learning-centre/how-much-is-really-needed-to-buy-affordable-housing

- https://www.globalpropertyguide.com/Asia/malaysia/Buying-Guide

- http://www.calculator.com.my/home-loan-calculator