In sickness and in health, in hardships and in wealth— those are often promises made by two people in their celebration of love. In fact, love is an exciting and wonderful part of life, and couples bubble with joy as they anticipate their new lives together. Most move into new homes— they buy new furniture, and for some, they start making plans to expand their family with little ones.

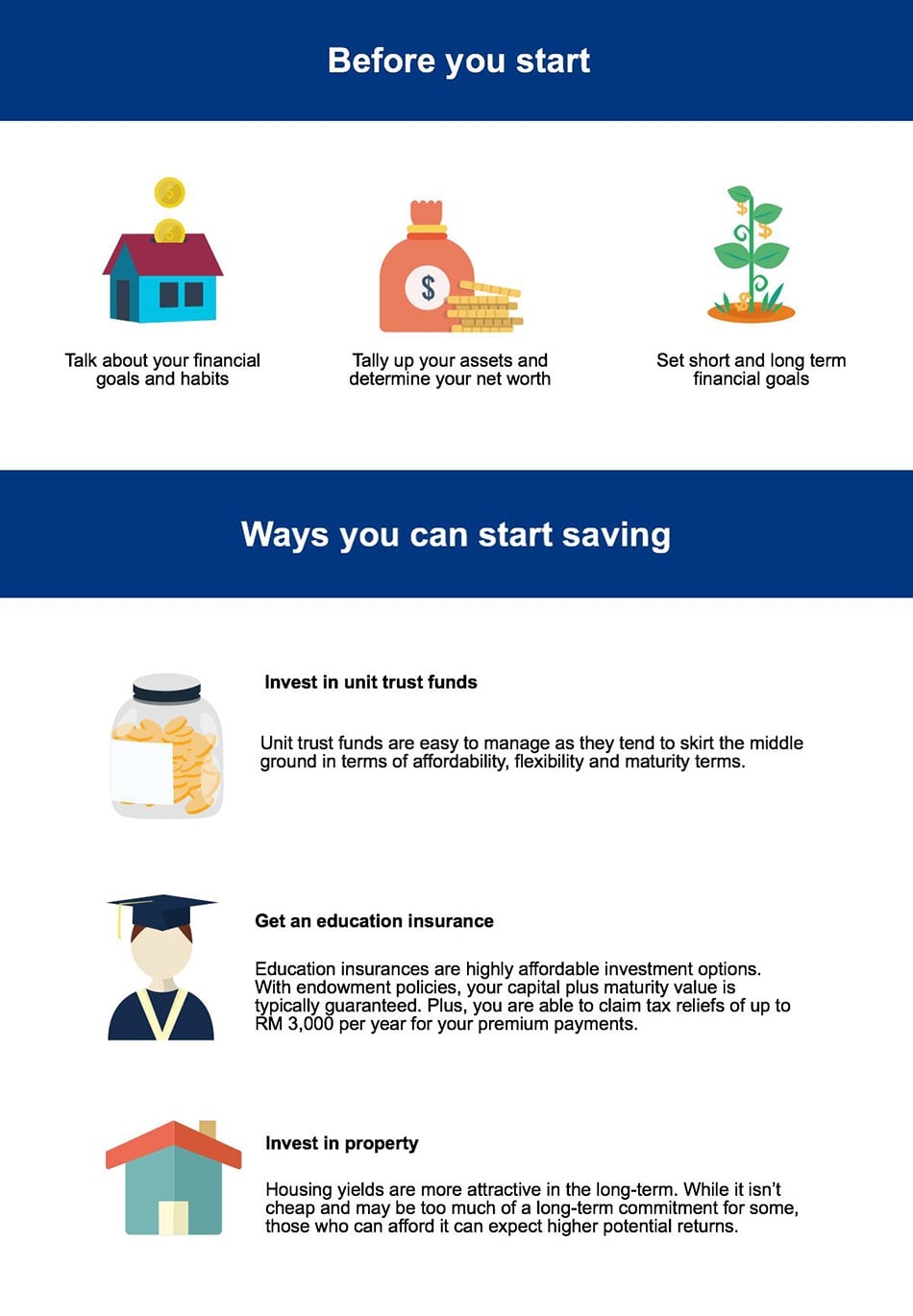

There’s a lot that goes into family planning. It is both exciting and arduous, joyful and sometimes a little scary too. But if you get an early head start by planning and setting financial goals with your loved one, you will spare yourself the hassle of worrying later. Sound financial planning isn’t as difficult as it seems, and it goes a long way in comfortably providing for your family.

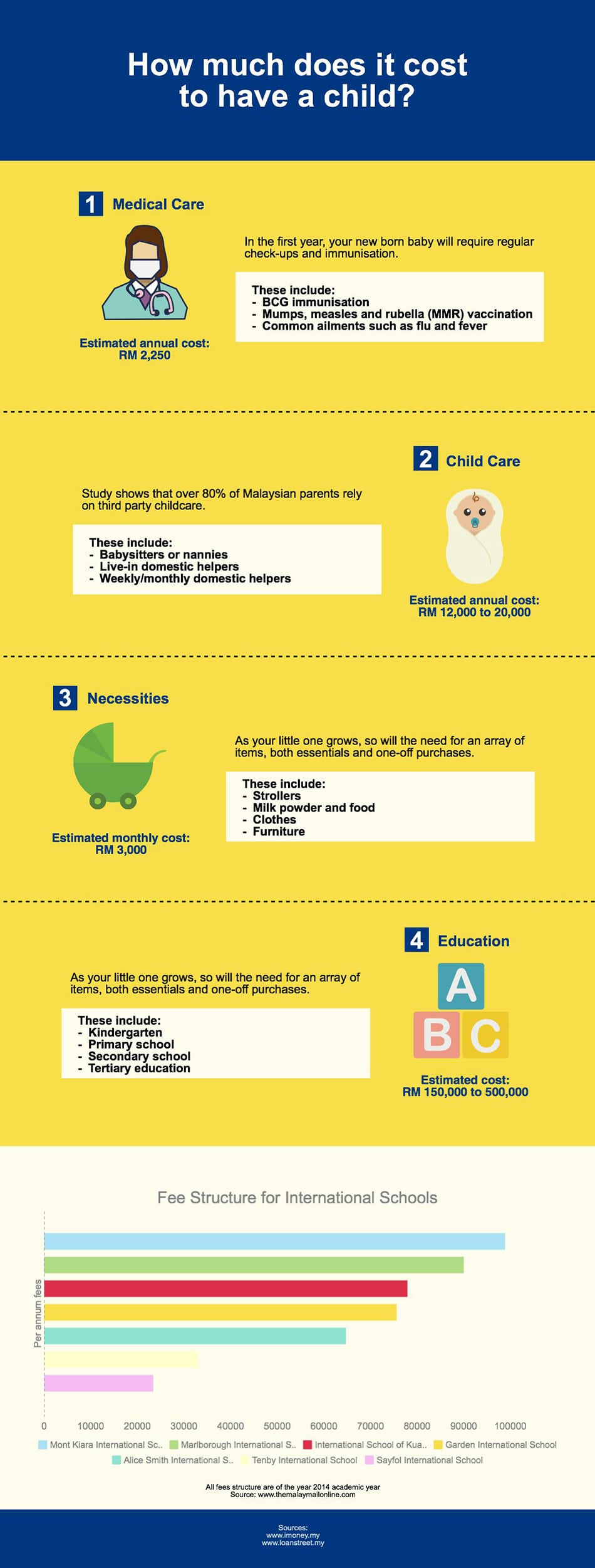

The first step is to get acquainted with the costs that you may be dealing with in the future. Having a child in Malaysia, though not necessarily expensive, isn’t cheap either. There are many costs to be considered and other unforeseen expenditures to prepare for.

Here’s a simple breakdown of what you may expect when you’re expecting: