We often have an idea of what our goals are in the next one, five or ten years. We might aspire to advance in our careers, build a family, pick up a new skill or even travel the world. However, when asked about retirement, many of us don’t usually know what to think of it. Because it’s too far ahead in the future, the idea of retirement often seems far-fetched to many of us.

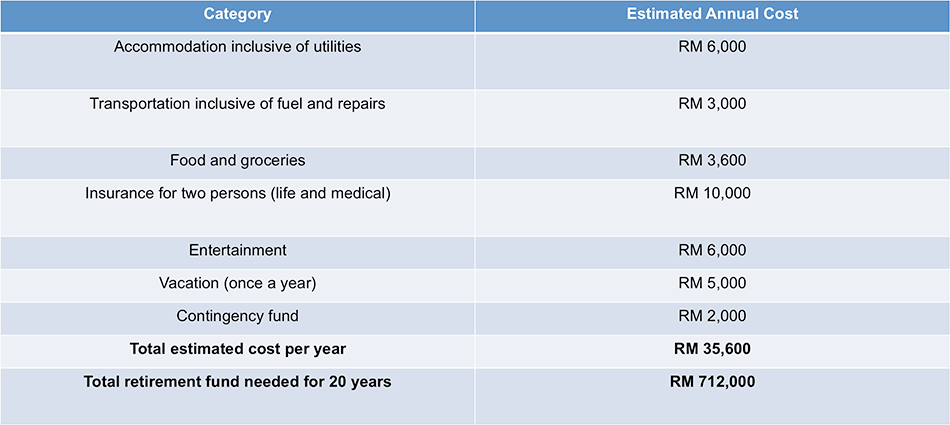

Thinking about retirement can be stressful to many. Though, the key to retirement planning is not about knowing exactly what will happen in the future, but coming up with an educated estimation of how much you will need and how to achieve it before your last day in the workforce.

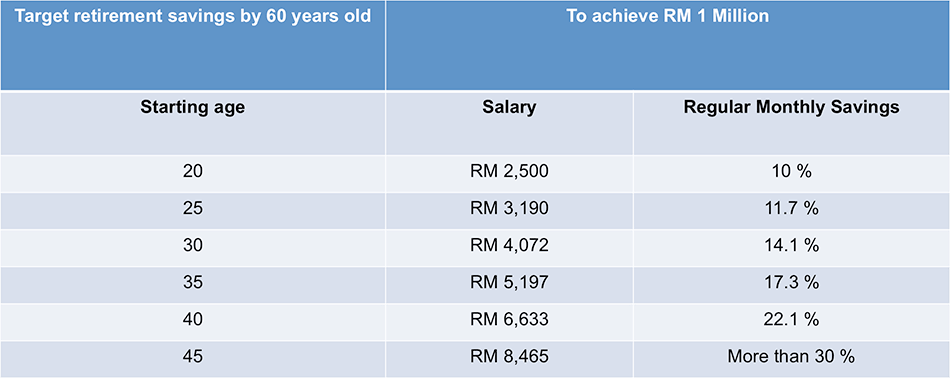

If your question is “When should I start saving?”, our answer is a simple “Now”. It is never too early to start saving for your retirement. In fact, the earlier you begin— say in your 20s or 30s— the less likely you’ll be weighed down by soaring expenses and unforeseen circumstances in the future.

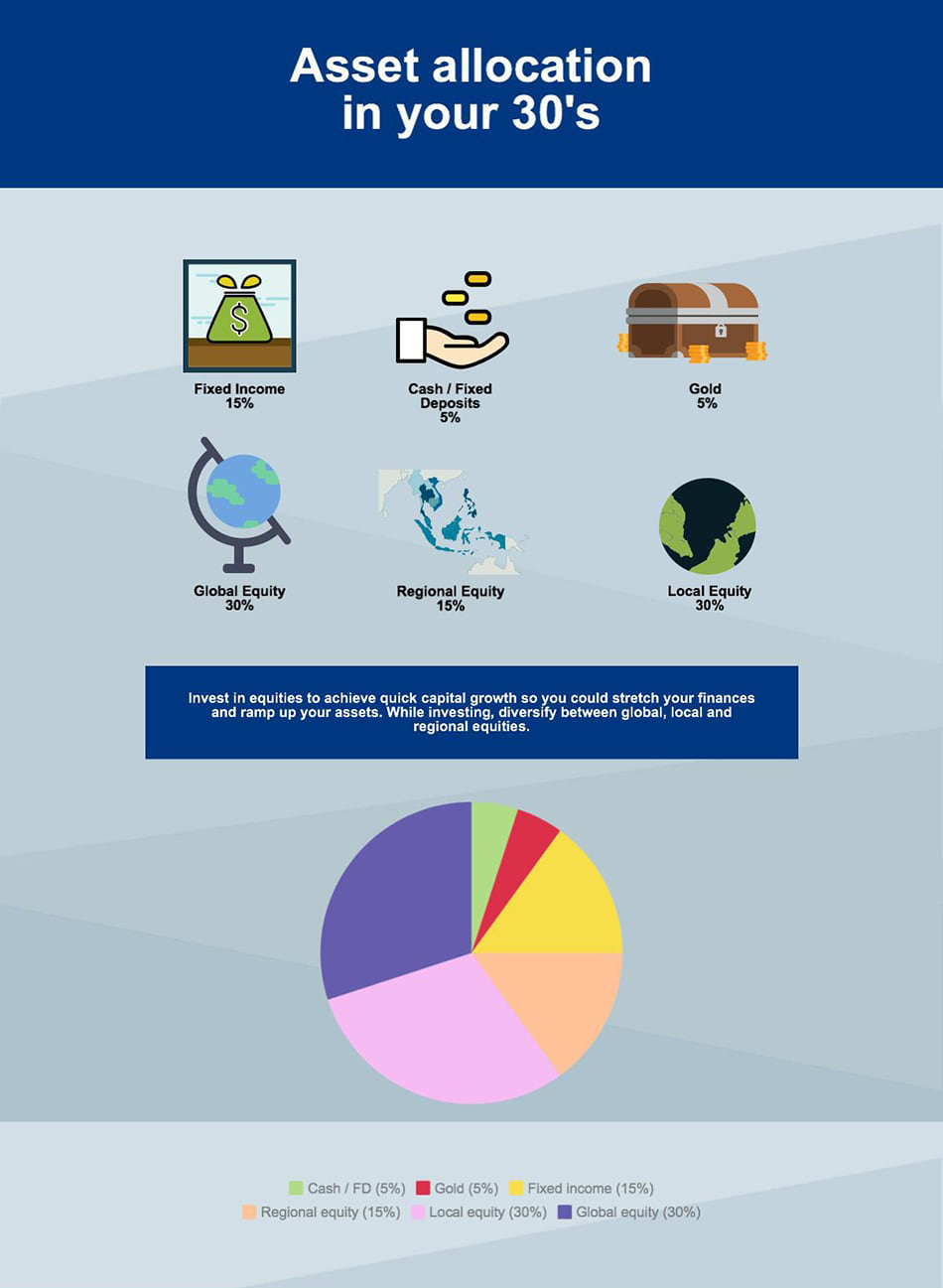

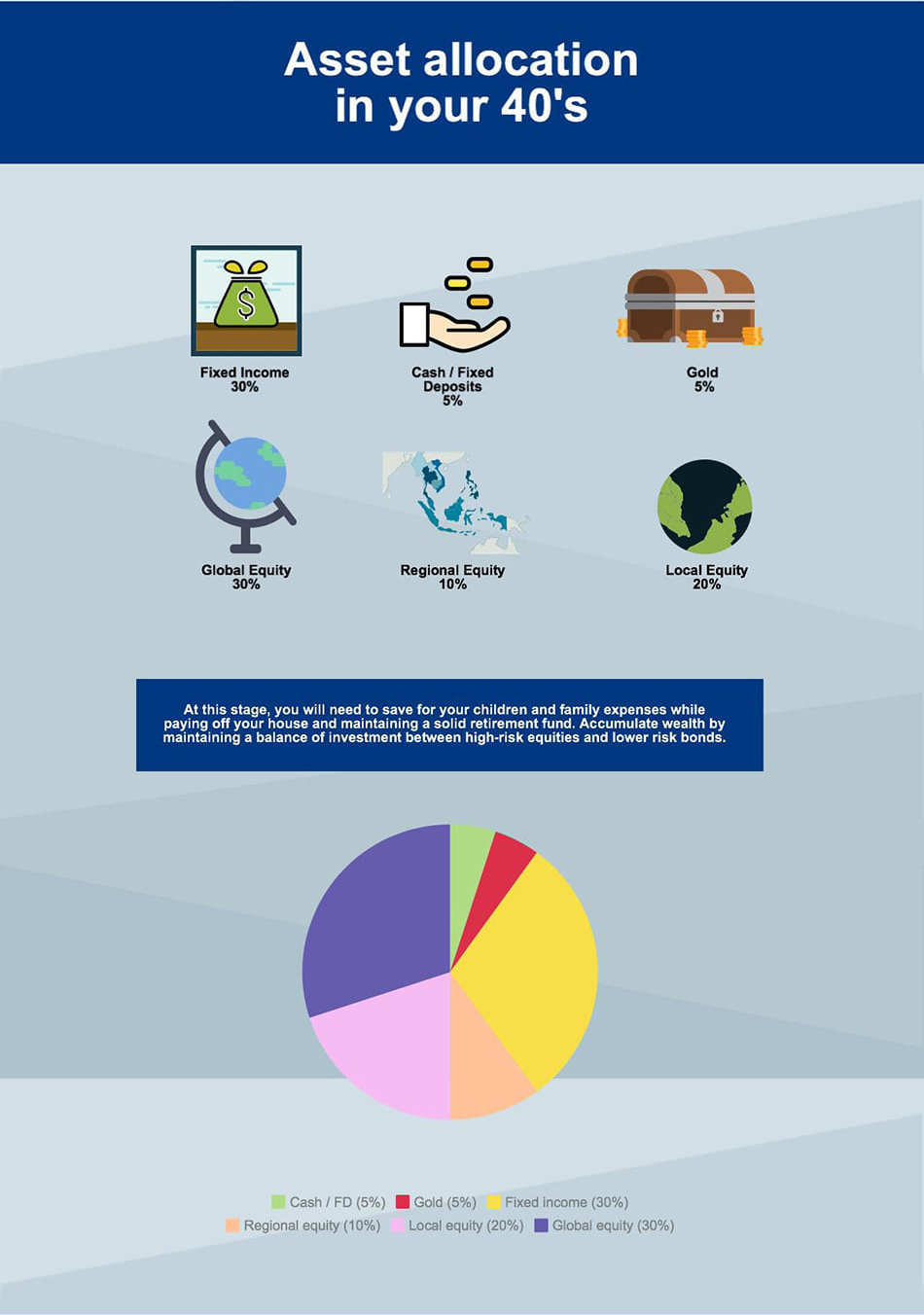

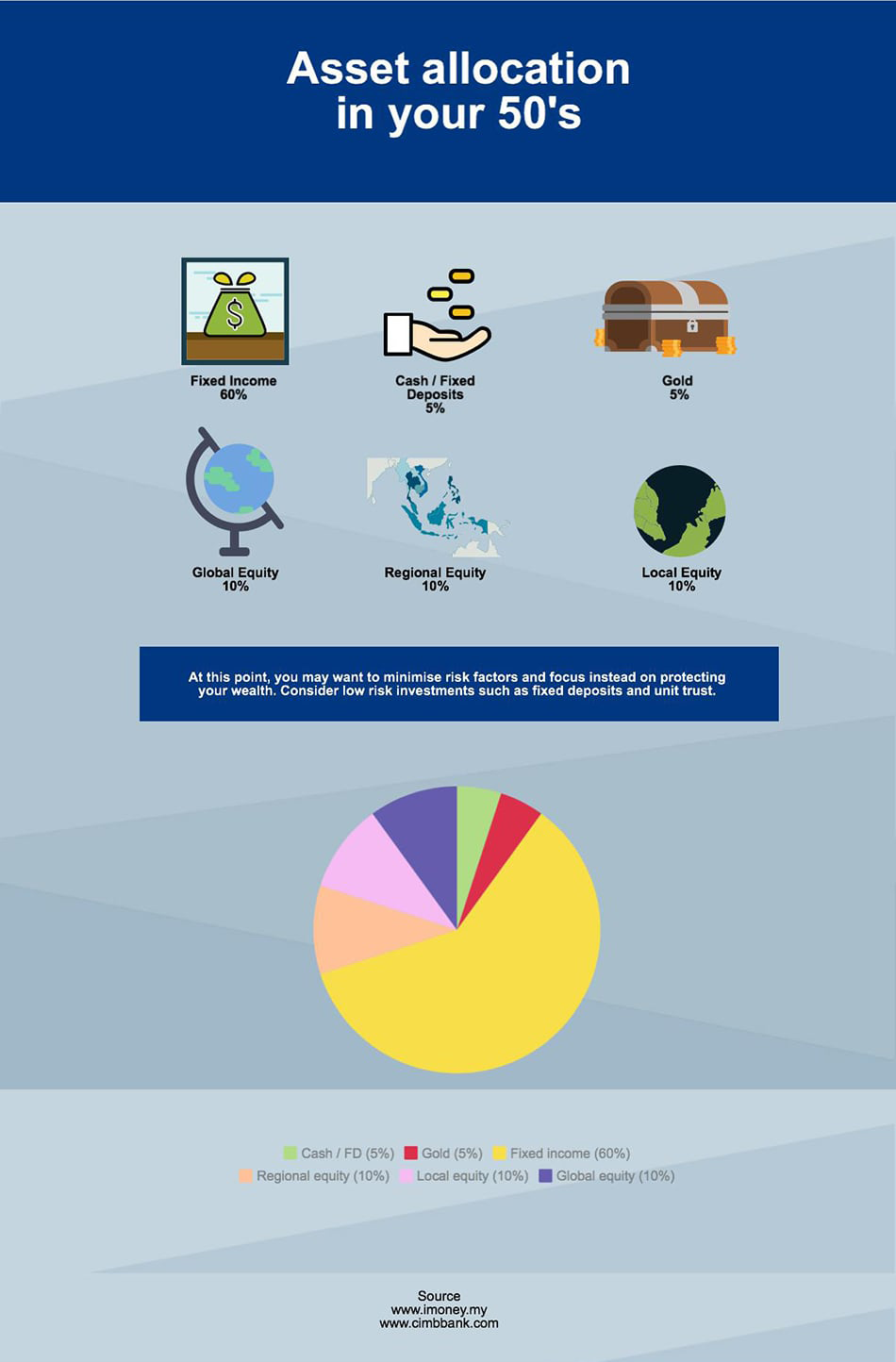

Here’s a comprehensive guide on how much you should save for your retirement, and how you can do so effectively.